What is Core Value?

SIMPLE, SAFE, SAVINGS without compromising on quality

Core Value operates on a reference-based pricing model, setting benefits based on a multiple of the Medicare reimbursement rate (or an equivalent standard), rather than the billed amount. This approach can lower the costs of your members’ claims, resulting in savings for both you and your group’s members.

Simple

Safe

Savings

Core Value’s rates are typically lower than those of self-funded plans with a network, helping you save on your monthly expenses.

The savings keep adding up! — In years when claims are lower than anticipated, you may receive money back from your claims account.

Quality

The coverage your employees need and expect.

All employer-established health benefit plans comply with Affordable Care Act standards. Preventive care coverage meets Affordable Care Act requirements and provides first-dollar benefits.

How the Core Value Program Works

Plan Education

For your reference-based pricing (RBP) plan to be successful, it’s crucial for you and your members to understand how it works. We offer all the resources necessary to educate your members about their plan.

Plan Utilization

Core Value has no network restrictions, allowing members to see any provider that accepts the plan. To assist members in finding high-quality, cost-effective providers, Healthcare Bluebook is included.

Claim Payment

Core Value pays providers a consistent, fair price for services based on a multiple of the Medicare reimbursement rate. After processing the claim, an Explanation of Benefits (EOB) is sent to members to outline their payment responsibility.

Member Advocacy

Program (MAP)

This concierge service addresses members’ questions. If members receive a bill exceeding the patient responsibility listed on their EOB, MAP collaborates with the provider to negotiate and resolve any discrepancies.

Resolution

When a bill is negotiated, a new EOB and letter of resolution are sent so the

member is confident any discrepancies have been resolved. MAP’s expert team makes member satisfaction a top priority.

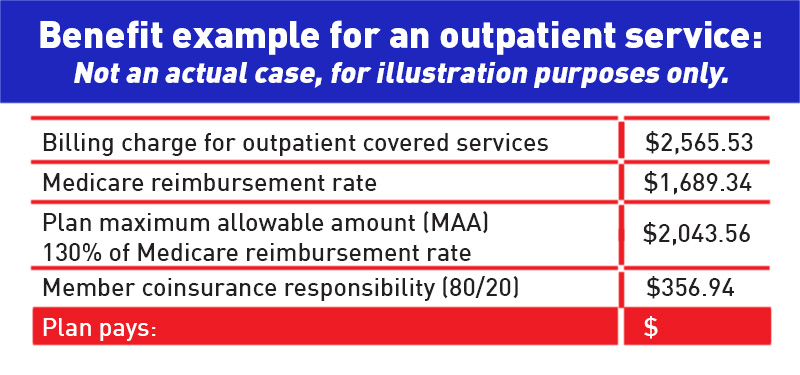

This plan determines benefits based on a multiple of the Medicare reimbursement rate or other derived equivalent.

Core Value determines benefits at the following rates for covered services:

• 130% of the Medicare reimbursement rate* for doctor office visits.

• 150% of the Medicare reimbursement rate* for inpatient services.

• 130% of the Medicare reimbursement rate* for outpatient services.

• 100% of the Medicare reimbursement rate* for dialysis. custom heading element

With Core Value, the plan reimburses the same amount — no matter which health care provider members choose.

The following services still rely on the use of network providers:

Pharmacy Benefits:

Members must use the Cigna PBM Network — a network providing access to over 68,000 retail pharmacies.

Transplants:

This plan uses a list of nationally recognized designated providers.

Core Value gives you options with flexibility and access.

Core Value Flex

Flex allows you to experience the savings of our Core Value with the flexibility to switch to a PPO network mid-year without a change

in your monthly payment.

Core Value Access

Core Value Access gives you the savings of a reference-based pricing plan and access to a network for physicians.

Product availability varies by state.

* Or other derived equivalent

1 Sometimes members may be balance billed for the amounts in excess of the plan MAA.

This is where the Member Advocacy Program can help.